CFTC Positioning Report: Bearish bets dominate the US Dollar

The most recent CFTC Positioning Report for the week ending July 1 highlights a significant uptick in risk-on trading. Market participants were actively evaluating the Trump-brokered ceasefire in the Middle East alongside further progress in the US-China trade negotiations.

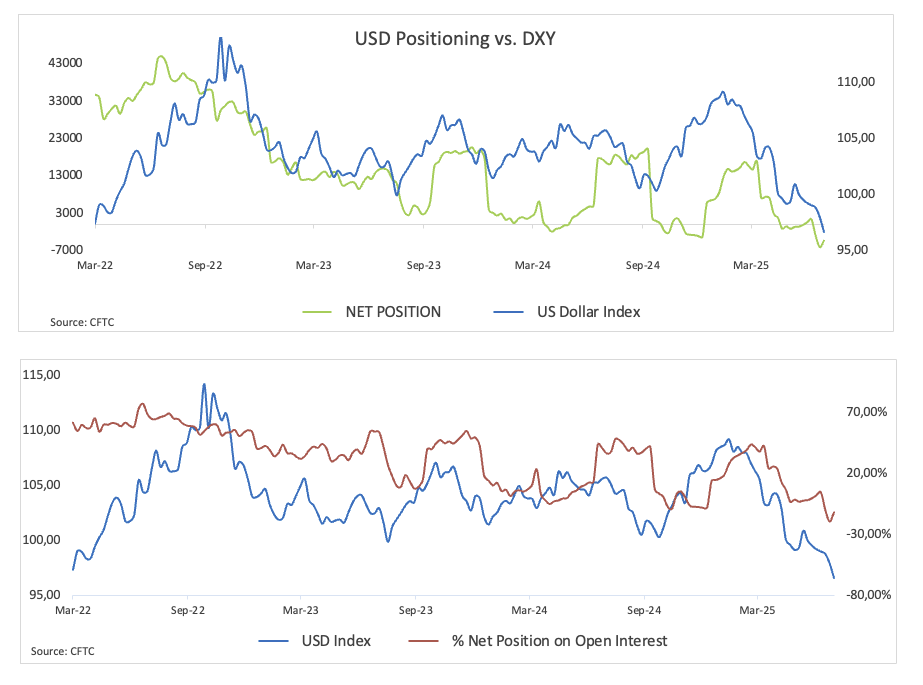

Non-commercial net shorts in the US Dollar (USD) have fallen to two-week lows, reaching approximately 4.3K contracts. This decline occurs alongside a fifth consecutive increase in open interest, which has now reached levels not observed since mid-March, around 36.3K contracts. The US Dollar Index (DXY) continued its downward trajectory, slipping to multi-year lows near 96.40.

Speculative net longs in the Euro (EUR) have experienced a modest decline, now standing at approximately 107.5K contracts. Commercial players, predominantly hedge funds, have decreased their net short positions to approximately 160.6K contracts, although they remain near multi-month highs. Moreover, open interest has reached three-week highs, surpassing 779K contracts. EUR/USD has continued its strong recovery, breaking through the 1.1800 level for the first time since September 2021.

Non-commercial traders have seen a continued decline in net longs for the Japanese Yen (JPY), with current holdings dropping to approximately 127.3K contracts, marking multi-month lows. Commercial players have ramped up their bearish positions to nearly 151K contracts, marking a three-week high. This shift occurs amid a third consecutive decline in open interest, which has now fallen to approximately 314.2K contracts. The continued downward pressure has driven USD/JPY to multi-week lows around 142.60 during that period.

Speculators have decreased their bullish positions on the British Pound (GBP), cutting their net long exposure to approximately 31.4K contracts, marking a six-week low, coinciding with the second consecutive weekly increase in open interest. The intense decline in the Greenback has propelled GBP/USD to approach the 1.3800 mark, a level not seen since October 2021.

Speculative net longs in Gold have increased to nearly 202K contracts, reaching a multi-week high as open interest experienced a resurgence, climbing to approximately 437.7K contracts. Gold prices experienced a downward trend, falling to six-week lows near $3,245 per troy ounce, driven by a decline in safe haven demand.

Non-commercial net longs in WTI have risen for the fifth consecutive week, reaching multi-month highs close to 234.7K contracts. This development occurred alongside an increase in open interest, reaching three-week highs of approximately 1.990 million contracts. During that period, traders focused on consolidating the significant retracement from levels exceeding $77.00 per barrel down to the $64.00 region, a pronounced shift that followed the ceasefire in the Middle East.