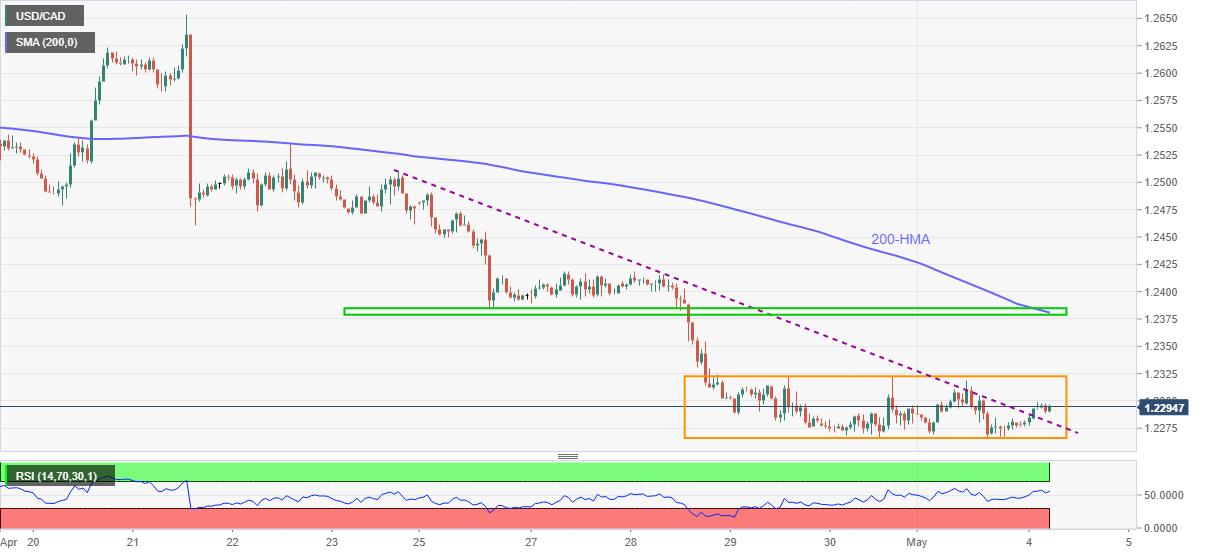

USD/CAD Price Analysis: Corrective pullback needs validation from 1.2322

- USD/CAD prints mild gains on breaking weekly falling trend line.

- Upbeat RSI teases bulls but a clear run-up past immediate trading range becomes necessary.

- Bears can keep 2018 low on radars until witnessing an upside break of 1.2385.

USD/CAD picks up bids towards 1.2300, up 0.10% intraday, while heading into Tuesday’s European session.

In doing so, the quote portrays a small recovery move following the clearance of a descending trend line from April 23.

Although the upbeat RSI conditions back short-term USD/CAD buyers, the quote is yet to overcome a four-day-old trading range between 1.2266 and 1.2322.

Also acting as an upside barrier is the 1.2378-84 region comprising 200-HMA and April 26 low.

Meanwhile, USD/CAD sellers need a clear downside break of the previous resistance line near 1.2280 to challenge the latest low near 1.2265.

It should, however, be noted that the USD/CAD downside past-1.2265 will aim for a 2018 low of 1.2248 before directing bears toward the late 2017 bottom close to 1.2060.

USD/CAD hourly chart

Trend: Bearish